Promoting women’s involvement in finance

The Global Gender Gap Report 2020 has forecasted that if we continue at the same painstakingly slow rate of progress in efforts to reduce the gender gap, in terms of economic participation and opportunity, it will take 257 years to close. Despite making up half of the world’s population, women are consistently under-represented in the labour force and even more so in professional and technical roles. The finance industry has regrettably done very little to close this gap in terms of either its own employment profile (particularly in senior leadership roles) or by persuading companies, with which it has relationships, to do so.

As of 2018, only 12.2% of the world’s CFOs were women. In the face of this daunting outlook for women in high-powered careers, the Clare College Cutty Sark Investment Society (CCCSIS) was founded in 2016 to empower women with transferable skills and the confidence not only to pursue a career in finance, but to challenge the patriarchal society in which we live.

The Society was seeded by the family trust of a Clare alumnus with a career in the investment sector. He was “prompted by gratitude for matriculating at all despite mediocre A-level results, a guilty conscience for only achieving a third-class degree, and a recognition of how poorly represented women were in his chosen profession.” The Society was named after a colourful character in his favourite poem, ‘Tam O’Shanter’ by Robert Burns. The Society’s Fund was started with a generous donation of £70,000 which the Society could freely invest and has been aided since its inception by the outstanding support and advice of Louise Hudson, who we hope will remain a valuable ally to the Society for years to come. I would also like to thank the Clare Development Office and the College Bursar who were key players in the Society’s establishment, as well express the Society’s gratitude for the assistance from the Nicholas Hammond Foundation.

The Society’s overarching purpose is, of course, to tackle the significant underrepresentation of women in the investment management sector, for which there is no single root cause. The proportion of young women wanting to join the industry is very small; many firms find that as many as 80% of applicants for investment roles are men. This may be due to the financial services sector’s poor public image, being typically more associated with greed than responsible stewardship (as exemplified by films such as The Wolf of Wall Street).

The current lack of female representation is also a factor, further discouraging young women to try to overcome this male-dominated environment. Women already in the industry have experienced their opinions being dismissed, are refused promotions due to maternity and can find it extraordinarily difficult to earn the respect of male colleagues. In a relatively recent study entitled “The Athena Doctrine” John Gerzema and Michael D’Antonio concluded that people’s definition of leadership follows stereotypically ‘male’ characteristics. As a result, women frequently feel the need to ‘masculinise’ their traits in order to survive, and be respected, in male-dominated environments. To combat these restricting factors, the Cutty Sark Society provides a safe environment to make mistakes, to learn, to ask questions and gain valuable experience without the unnecessary pressure inflicted by a masculine environment.

Society meetings are held weekly in Michaelmas and Lent terms. This 2019-2020 academic year, given the diverse range

of academic backgrounds of new members with only a few studying economics, teaching the fundamentals of finance was the focus of Michaelmas term. These lessons have included how to analyse financial statements, how to create a DCF model, and explanations of financial jargon, to name a few. In Lent term, members had the opportunity to utilise their skills to pitch a company of their choice on which the Society voted whether or not to invest. Meetings also typically include a weekly news review, focusing on matters that may affect the Society’s fund, followed by a discussion of the portfolio’s progress in comparison with global market performance.

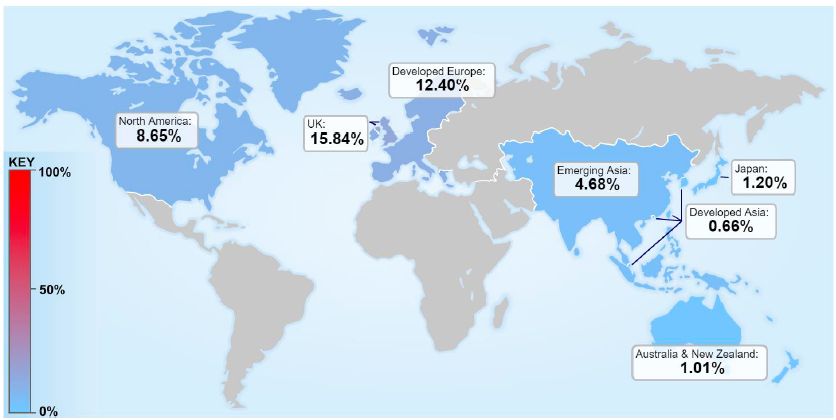

Geographic diversification of the Fund

Geographic diversification of the Fund

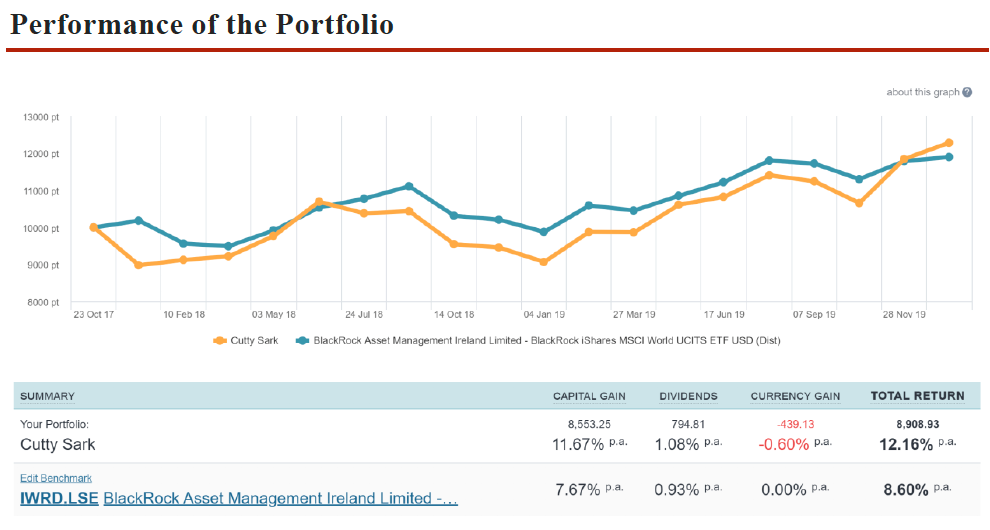

In terms of the portfolio itself, the Society aims to reduce risk by spreading investments across various industries and between funds and shares. For example, the portfolio currently covers the health, gaming, technology, beauty and retail industries. It is also diversified through the use of the MSCI World Index, as opposed to the FTSE UK, allowing access to global and emerging markets. Generally, investments are based on a five-year investment horizon meaning, unfortunately, most members will not be able to see the long-term outcomes of their investment decisions. However, this does provide a legacy for the Society, passing down the skills and insight to allow future generations of students to continue the progress the Society has made.

Personally, I have found pitching companies at society meetings a really informative and insightful experience. They allow one to thoroughly investigate a company or industry of interest and apply the skills we have been taught in meetings. Other members will, naturally, challenge what has been presented, in the same manner as professional investors. Without the pressure of a working environment, we can focus on the core skills and concepts of investment management in a constructive manner. This has been the most valuable takeaway for me.

Core to the Society’s ethos, with regards to investment decisions, is the focus on Environmental, Social and Corporate Governance (ESG). ESG has very recently become an integral part of many investors’ analyses due to increased awareness of the current climate crisis, the aforementioned gender gap and other inequalities within employment and management structures and stakeholders’ concerns over sustainability. There is a hope that the Society’s focus on this will contribute to a larger effort to reduce inequality and environmental damage augmented by the finance industry.

Throughout this academic year the Society has also hosted some fantastic alumni events. I would like to take an opportunity to thank Katie Potts from Herald Investment Management, Vera German from Schroders and Julius Bleinroth from Zouk Capital for delivering events in College and for providing such engaging and valuable insight into their industry. If any alumni would be willing to share their experiences by delivering an event or simply wish to be involved with the Society, please do not hesitate to contact the President, Wen Yeh Lee (wyl41@cam.ac.uk) and Vice-President, Sophie Yaxley McLellan (sy386@cam.ac.uk).

The Cutty Sark Investment Society hopes to address some of these wider societal issues by providing a nurturing and progressive environment for young women to explore investment management. It is often disheartening to see the lack of female representation in senior positions in the finance industry, but with societies like this and growing efforts to close the gender gap, I believe we can inspire a future generation of women to progress, unhindered and undeterred,

in fulfilling their aspirations.