Bursar's Report 2019-20

Paul Warren, Bursar & Fellow of Clare College

I would like to start on a few positive notes. One thing this crisis has highlighted, although we were never in any doubt, is the powerful connection the College has with our alumni community. Your steadfast support has never been more important and has made a real difference this year. I would also like to commend our staff and Fellows who have risen to challenges across all departments and disciplines.

Emergency Funds

During the first lockdown, the academic work and life of the College continued remotely. While the gates to the College were closed, 98 permanent staff members and 29 casual staff were placed on furlough. This left 45 staff members continuing to work from home or providing essential services in College, including our porters who were the first contact for those students remaining in Memorial Court.

Permanent staff on furlough continued to receive 100% of their pay. Casual staff were guaranteed an average of their previous monthly wages and this was funded by donations from our Fellows who set up a separate fund to support our temporary staff.

The Emergency Fund provided support to our students during these challenging circumstances. Initially, this covered unexpected travel costs at the start of lockdown and helped subsidise costs for those who had no choice but to remain in College. The fund will now help us to cover the cost of bursaries and hardship funds this financial year. So far, the fund has raised £120,428, with a further £21,000 from the Fellows for casual staff. The Nicholas Hammond Foundation generously made a further £50,000 grant to the fund that will allow us to offer support throughout the 2020-21 financial year.

The Financial Situation

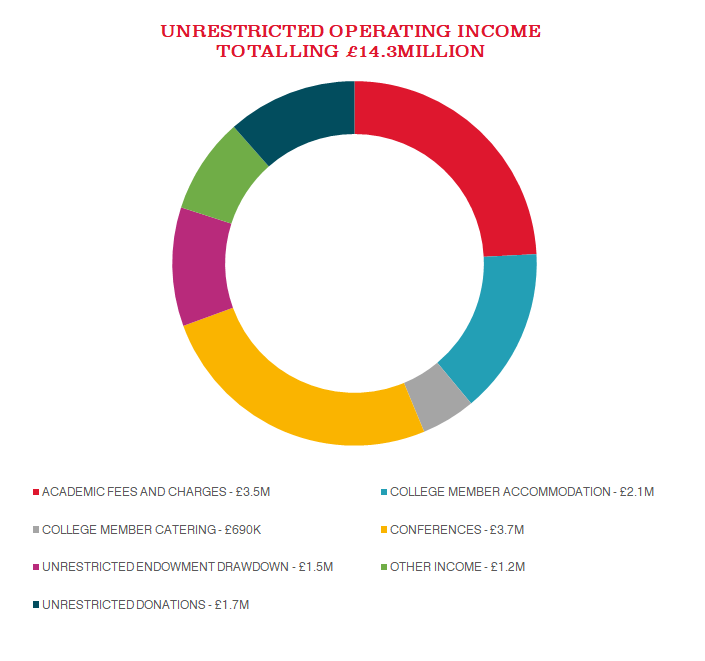

Even prior to COVID-19 the financial environment for Clare had become increasingly challenging. While the undergraduate fee had remained fixed, pressures to increase expenditure on outreach, mental health support and education in general have all led to the emergence of a substantial structural financial deficit. Between 2014 and 2019, our total income increased by only 5%while total expenditure increased by 38%. The growth of conferencing income to more than £3.6 million in 2019 helped to mitigate some of the magnitude of the underlying operating deficit, that has nevertheless grown over time.

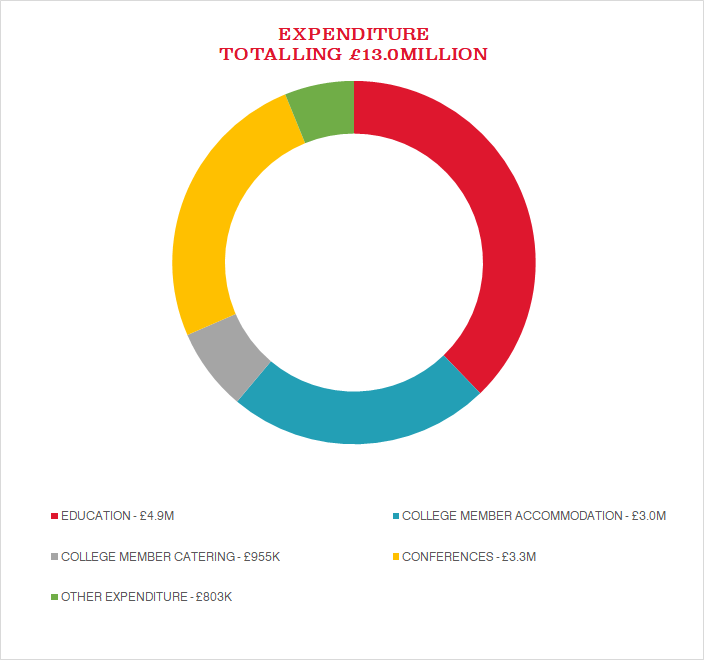

Standards at the top of Higher Education are continuing to rise and Clare is determined to stay in the top echelon globally. During the year ended June 2020 this meant the College spent £11,000 on the education of each undergraduate student, mainly on the intensive support provided by each student's Director of Studies and supervisors. In addition, the College spent £5,124 on the education of each graduate student. The total cost of educating 475 undergraduates and supporting 186 graduate students was £6,316,000, which can only be sustained through the generosity of benefactors. The College receives a contribution equating to £4,625 for each new undergraduate by way of the College Fee, but this leaves a shortfall of £6,375 for each undergraduate student, amounting to 58% of the total cost.

Changes to Higher Education funding and student finance have resulted in increased levels of debt for students, which will inevitably lead to heavy pressure on Clare's hardship funds. During the year the College made total bursaries and awards of £820,602 to undergraduate and graduate students. In addition to bursaries and other grants, the College offers subsidies on the cost of food and accommodation as extra undergraduate and graduate student support.

The College originally budgeted for an operating deficit of £946,000 in the 2019-20 financial year. As a result of higher than anticipated unrestricted donations (which increased to £1,652,000, mostly due to a large legacy gift), £427,000 of furlough-related grants and a £341,000 write back of USS pension provisions, the audited financial accounts for the year to 30 June 2020 show an operating surplus of £1,345,000.

With COVID-19, the 2020-21 conference income will decline from £3.7 million to almost zero. Total income is forecast to decline by 30% to only £10.9m. Despite efforts to reduce expenditure, the College is forecast to have a deficit of more than £3.2 million. Conference activity is not expected to recover to pre COVID levels for several years and there is a risk that more conference events will be held virtually in future. This means that, despite the 2019-20 surplus, the College faces a very challenging financial outlook. If sizeable operating deficits are reported in coming years it may be necessary for the College to liquidate endowment assets to fund the expected cash flow deficit.

These circumstances dramatically highlight the importance of donations to Clare. This past year, alumni and friends donated £6.7 million. This included £3.3 million for Old Court, nearly £500,000 for the Clare Fund, and a further £1.1 million in unrestricted legacy donations. Modest monthly or annual donations are essential, making up much of our unrestricted income, particularly as conferencing revenue is lost. This donation income is crucial in helping us to recover long term, allowing us to continue supporting our students though bursaries, facilities, outstanding teaching, and pastoral provisions.

Endowment

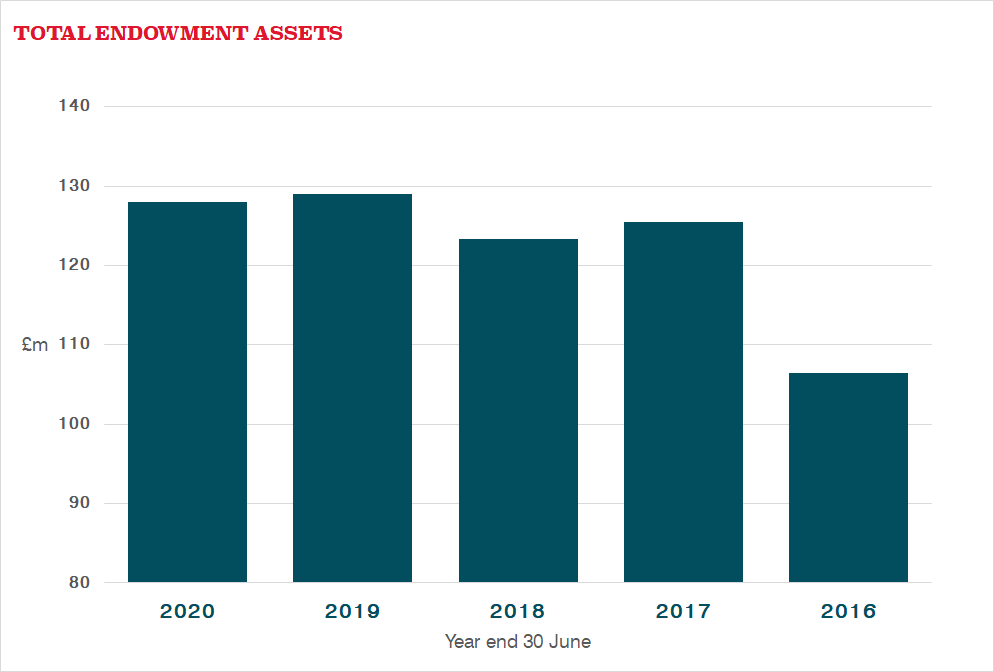

The market value of the endowment investment portfolio at 30 June 2020 was £128 million, with 68% invested in global equities, 22.6% in commercial and agricultural property in the UK, 4.4% in cash deposits and short-dated bonds, and 5.0% in private equity. The College's global equity investments are mainly held in regional tracker funds with 23.1% invested in the UK, 28.5% in the US, 18.2% in Europe, 13.5% in Japan, 13.7% in Emerging Markets, and 3.0% in the Pacific Rim. Foreign currency exposures are not hedged.

The Endowment achieved a total return of 0.9% net of all investment management costs. Over the same time period the FTSE All Share index showed a negative total return of 13%, and the College’s strategic benchmark, consisting of 75% global equity and 25% UK commercial property, showed a negative total return of 0.2% in sterling.

Low Carbon Endowment Fund

The Investment Committee recently undertook a review of its ethical and environmental investment policy.

Over the coming year 80% of the global equity investments will be transferred into the Amundi Global Equity Low Carbon Fund. The benchmark for this fund is the MSCI World All Country World Index and the investable universe for the fund excludes all companies with carbon revenues or carbon reserves. The fund is fossil fuel free and will also have a tilt to companies with relatively high ‘Green’ revenues. This move will dramatically reduce our exposure to fossil fuel and carbon intensive industries.